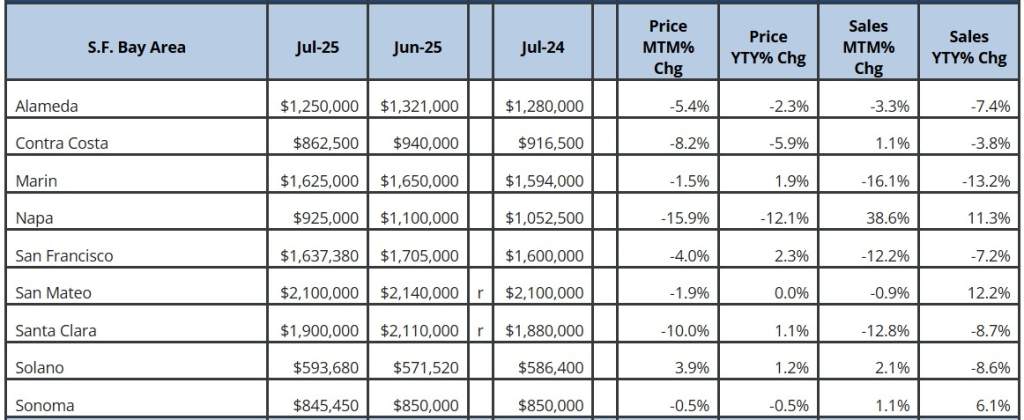

As we move into the second half of 2025, the Bay Area real estate market continues to feel the ripple effects of larger economic forces. Inflation remains persistent, consumer spending shows surprising strength, and small business owners are cautiously optimistic. At the same time, California housing affordability remains close to cyclical lows, creating challenges for buyers and sellers alike.

California Housing Affordability Near Cyclical Low

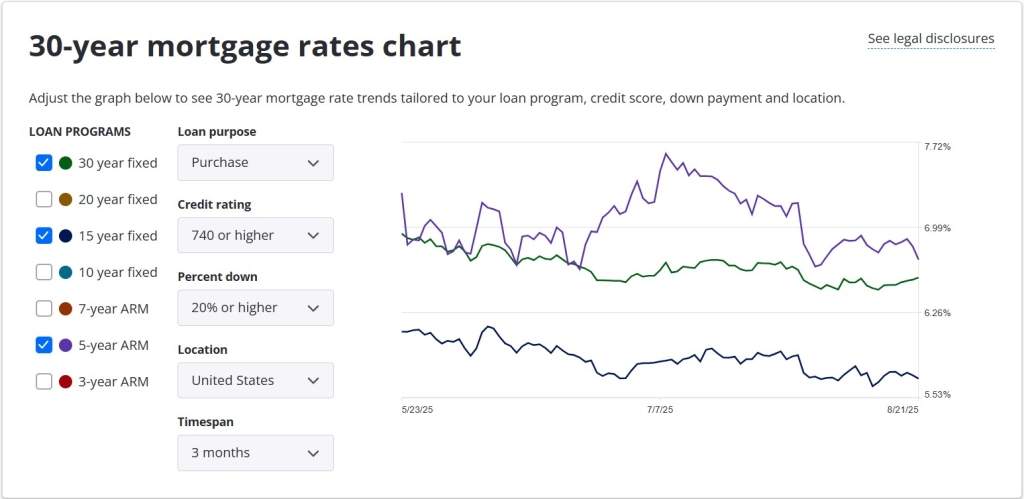

Housing affordability in California slipped again in the second quarter of 2025, falling to 15% from 17% in the previous quarter. Despite this decline, it did inch up slightly from the same period last year. A household now needs an annual income of roughly $232,400 to afford the state’s median-priced single-family home, with monthly payments around $5,810 at an average 30-year fixed mortgage rate of 6.9%. While these rates are below last year’s peak, they remain elevated enough to keep affordability strained. Compared to a year ago, 41 counties saw improvement, while a handful saw declines or no change. With rates expected to fluctuate in the months ahead, affordability may not shift much in the third quarter.

Inflation Still Pressing on Households

Inflation continued to weigh heavily on U.S. households in July. The Consumer Price Index rose 0.2% from June and 2.7% year-over-year, driven largely by gains in services. Core CPI, which excludes food and energy, increased 3.1% compared to last year, marking its highest level since February. Airline fares jumped 4%, while medical care and transportation services also saw solid gains. On the wholesale side, the Producer Price Index climbed 0.9% in July, significantly above expectations. Together, these figures suggest that inflationary pressures are far from over, particularly as tariffs push costs higher and borrowing remains expensive.

Retail Sales Stay Strong, Helped by Prime Day

Despite higher prices, consumers showed surprising resilience in July. Retail sales increased 0.5% from the previous month, following a 0.9% gain in June. The strongest growth came from auto sales, furniture, and sporting goods. Amazon’s first-ever four-day Prime Day also gave sales a boost, extending the shopping event’s influence beyond its usual two days. While part of the sales increase may reflect higher prices rather than more items sold, the steady growth demonstrates that consumers are still willing to spend, though they are becoming more selective and price-conscious.

Small Business Optimism Back Above Average

Small business confidence made a notable rebound in July. The NFIB Small Business Optimism Index rose to 100.3, above its long-term average of 98. Owners reporting better business conditions jumped significantly, helped by legislative changes and record-high stock markets. However, uncertainty remains a concern, with the index measuring business owners’ uncertainty climbing to 97. While fewer businesses raised selling prices compared to June, many still plan to do so in the coming months, reflecting the continued challenge inflation poses.

The “Lock-In Effect” Easing, Slowly

One ongoing factor in the housing market is the “lock-in effect,” where homeowners with low mortgage rates hesitate to sell. In the first quarter of 2025, 81% of outstanding mortgage debt carried interest rates below 6%. About one in five homeowners still have rates under 3%, while nearly one-third hold rates between 3% and 4%. With rates remaining high, most homeowners are staying put. However, as more time passes, this dynamic is slowly shifting, and by the end of 2025, the share of mortgages below 6% may fall closer to 75%. This gradual easing could bring more inventory to the market, though affordability challenges are likely to persist.

What This Means for Bay Area Buyers & Sellers

For buyers, affordability remains stretched, but slightly lower rates than last year and the gradual easing of the lock-in effect may open new opportunities. Sellers still benefit from competitive conditions, but pricing homes realistically and presenting them well will be crucial to attracting buyers in a cautious market. Investors should note that while inflation and tariffs raise costs, strong consumer spending and improving small business confidence point to ongoing economic resilience in the Bay Area.