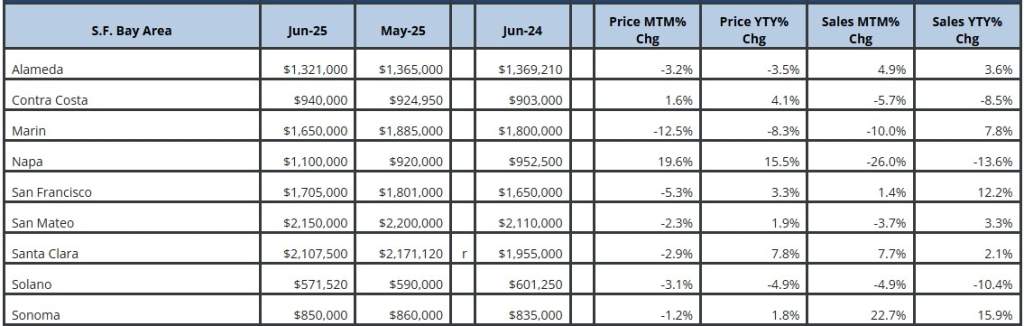

As the Bay Area continues to navigate a shifting real estate and economic landscape, several key indicators from June and early July 2025 paint a nuanced picture of opportunity and challenge. From easing mortgage rates and increased buyer activity to steep insurance hikes and renters struggling with financial literacy, this month’s insights reflect a market at a crossroads.

💼 Small Business Confidence Holds Steady Despite Tax Worries

In June, small business sentiment remained stable, with the NFIB Small Business Optimism Index dipping slightly by 0.2 points to 98.6—still above the historical average. While optimism about future business conditions softened, inflation concerns eased, and uncertainty declined significantly.

However, taxes rose as the top concern among small business owners, cited by 19%, while the share reporting excess inventories increased notably. Encouragingly, only 7% of business owners rated their situation as poor, and 57% rated it as either good or excellent. Labor quality concerns remained low, a positive sign for hiring and stability.

🏦 Mortgage Applications Surge Amid Easing Interest Rates

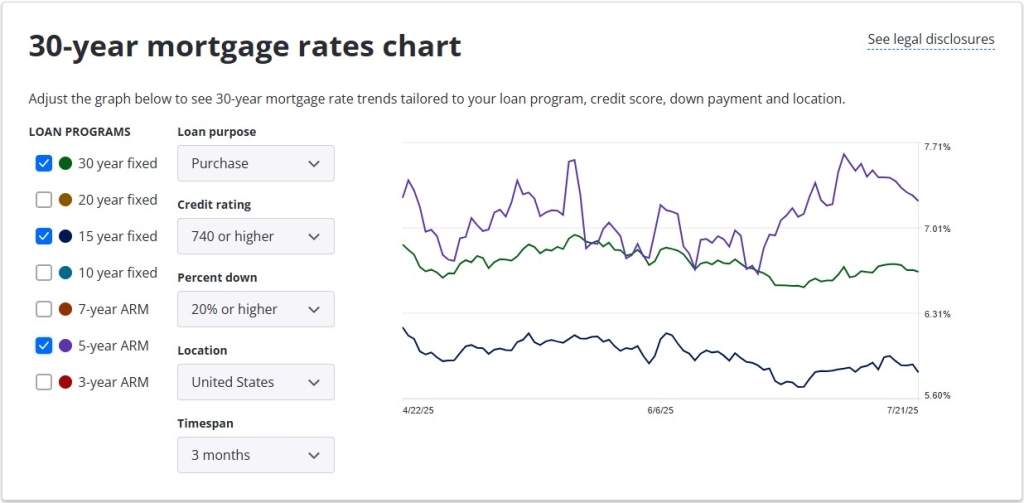

The early weeks of July brought renewed optimism to the housing market, as mortgage applications rose by 9.4%, driven by a drop in interest rates. The average 30-year fixed rate dipped to 6.77%, the lowest in three months, prompting a 9% increase in refinance applications and a 25% year-over-year jump in purchase applications.

While the unadjusted purchase index fell due to the July 4th holiday week, the seasonally adjusted numbers reflect the highest activity since February 2023. The cooling of home prices and increased inventory could provide relief to prospective buyers—if they can find homes to buy.

📊 Today’s Mortgage Rates – as of July 21, 2025

| Loan Type | Current Rate |

|---|---|

| 30-Year Fixed | 6.625% |

| 15-Year Fixed | 5.625% |

| 7-Year ARM (Adjustable) | 7.375% |

📉 Rates continue to ease slightly this month, encouraging more buyers to explore financing options heading into late summer.

With this trend, many prospective homeowners are re-engaging with the market, especially those waiting for better borrowing conditions. Lower rates, paired with softening home prices, might present a limited-time opportunity—before rates potentially rise again amid inflationary pressures.

🔥 Home Insurance Premiums Climb in California

One growing obstacle for both current and prospective homeowners is the rising cost of home insurance. Nationally, premiums are expected to rise by 8% to an average of $3,520, but California residents will see a much steeper increase—21%, bringing the average annual premium to $2,930.

The surge is largely due to increasing wildfire risks, especially in counties like Los Angeles, and the higher costs of construction materials and labor. These factors are making homeownership even more expensive, pushing some residents to reconsider moving or even insuring altogether.📚 Renters Remain Ill-Prepared for Homeownership

Despite a growing interest in buying, many California renters are simply not ready. The 2025 C.A.R. Consumer Survey reveals a troubling trend: low financial literacy is keeping potential first-time buyers on the sidelines.

Some key findings include:

58% don’t understand mortgage qualification requirements.

60% haven’t started saving for a down payment.

84% don’t know their loan eligibility.

83% are unaware of first-time buyer programs.

Only 18% understand their debt-to-income ratio.

These gaps—compounded by credit card debt (41%), student loans (20%), and car payments (16%)—highlight the urgent need for financial education and support.

🏠 Why California Homeowners Are Staying Put

One of the biggest factors shaping today’s tight housing supply? Homeowners simply aren’t moving. The same C.A.R. survey shows that 73% of California homeowners haven’t considered selling in the past year. Why? High mortgage rates and steep property taxes on new purchases.

60% say high mortgage rates are stopping them from selling.

57% cite new property taxes as a major concern.

More homeowners plan to stay 15–24 years in their current home—a trend that’s increasing each year.

This “lock-in” effect is reducing inventory, driving up competition, and making it more difficult for first-time buyers to break into the market—especially in high-demand areas across the Bay Area.

💡 Final Thoughts

The July 2025 Bay Area housing market is a study in contrasts: increased buyer activity amid lower rates, but fewer homes for sale due to economic pressures on both owners and renters. As affordability challenges persist and financial preparedness remains low, market participation may continue to be limited—unless broader reforms, education efforts, or financial incentives are introduced.